Business Resources

Global Business Hub

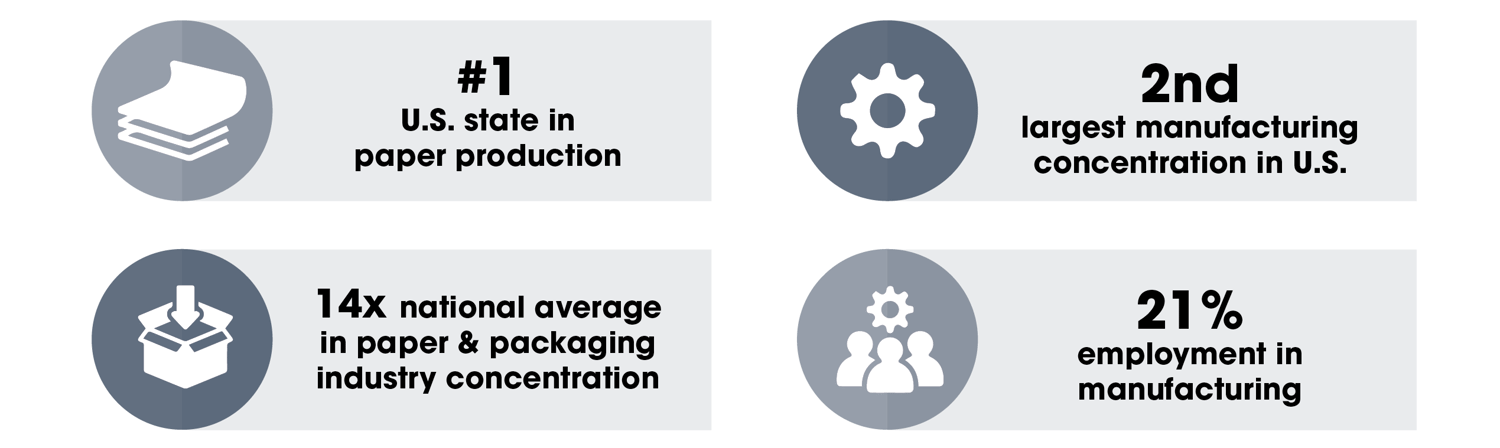

The Global Business Hub located in Green Bay, Wisconsin, is your global entry point for connectivity in the North American market. Wisconsin is the number one paper-producing state in the United States, employing over 30,000 people statewide with the Green Bay MSA having over fourteen times the national concentration of employment in the Paper & Packaging industry.

We are proud of our industry clusters beyond paper to include Food & Beverage Processing, Packaging, Transportation & Logistics, and Manufacturing as a whole. Greater Green Bay has an international port connected to the largest freshwater body of water, four major airports within 100 miles, and nine intermodal freight facilities within Brown County.

Greater Green Bay ranks highly (Top 28%) among U.S. metro areas for its FDI attractiveness. - U.S. Department of Commerce

Soft landing physical co-working location and U.S. mail services

The Urban Hub is a modern co-working space and programming hub located in the heart of Downtown Green Bay. It is professionally managed by the Startup Hub of the Greater Green Bay Chamber and houses the Global Business Hub.

The Urban Hub features the fastest Internet available in Green Bay and is conveniently located in the Railyard Innovation District. Members enjoy the convenience of booking spaces in real-time, easy invoice payments, and an array of amenities. On-site resources and memberships are driven by the unique needs of the modern entrepreneur and remote worker.

Providing you a U.S.-based mailing address and easy access to register your business in the state of Wisconsin.

Connections

As an International Member, we will support you through connections and partnerships we already have established. The Hub offers regular programming for startups and industry partners. You are invited to be part of events that are designed to share ideas and strategies for entering or growing your business in the United States.

Read about Greater Green Bay's global connections:

Italy - A Global Connection To Green Bay |

Connecting Canada to Greater Green Bay and Beyond |

Mexico and Global Greater Green Bay |

Lucca, Italy: The Paper Valley of Europe |

Why Green Bay

Greater Green Bay offers more than expected. In fact, we're confident that you'll be pleasantly surprised as we continue to evolve, grow, and innovate.

Explore the opportunity to make an impact right from the start, both at your company and in your community.

Enjoy an energetic lifestyle filled with natural beauty, endless outdoor activities, festive community celebrations, robust entertainment venues, and a short drive to even more options.

Experience a standard of living unmatched almost anywhere else in the country.

By building a life just a short drive from some of the biggest cities in the country, you have so much to gain without giving anything up. This is a place where you can truly have it all.